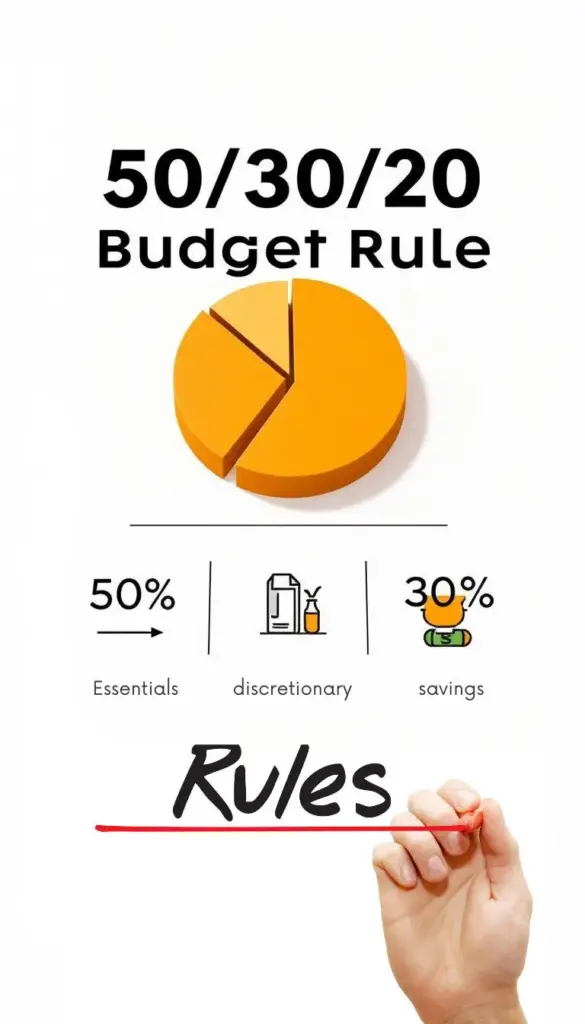

Managing your money can feel like a big task. But, it doesn’t have to be hard. A simple budgeting strategy can really help. The 50/30/20 rule is easy to follow and helps you split your income into three parts.

This personal finance plan ensures you use your money wisely. It’s flexible, so it works for many people’s budgets.

This guide will cover the 50/30/20 rule’s basics. You’ll also get tips on using it well.

Key Takeaways

- Understand the basics of the 50/30/20 budget rule.

- Learn how to allocate income towards needs, wants, and savings.

- Discover tips on adapting the rule to suit your financial situation.

- Implement a simple and effective budgeting strategy.

- Create a balanced personal finance plan.

What Is the 50/30/20 Budget Rule and Why It Works

Learning about the 50/30/20 budget rule can change how you handle money. It’s a simple yet powerful way to budget. It’s become popular around the world for its easy-to-follow steps.

The Origin and Philosophy Behind the Method

Senator Elizabeth Warren introduced the 50/30/20 rule in her book, “All Your Worth: The Ultimate Lifetime Money Plan.” It suggests using 50% of your income for needs, 30% for wants, and 20% for savings and debt. This method helps balance spending and saving, making sure you cover your basics and build for the future.

The Psychology of Simplified Budgeting

The 50/30/20 rule is all about keeping things simple. It breaks down expenses into three main groups. This makes budgeting easier and less stressful. It helps you stay on track with your financial goals.

- Reduces financial stress by simplifying budgeting

- Encourages savings and debt repayment

- Promotes a balanced approach to spending

Who Benefits Most from This Approach

This rule is great for those who find budgeting hard or are new to managing money. It’s also good for anyone wanting to change their spending to reach financial goals. This could be saving for a big buy or paying off debt.

Using the 50/30/20 rule can help you achieve financial stability. It’s a flexible plan that can be tailored to fit your needs. It’s a useful tool for anyone looking to plan their finances better.

Breaking Down the 50% for Needs

The first step in using the 50/30/20 budget rule is figuring out the 50% for essential needs. This big chunk of your income goes to necessary costs that keep you afloat. Let’s explore what these needs are and how to handle them well.

Essential Housing Expenses

Housing is a big expense. It includes rent or mortgage, property taxes, and insurance. To cut down on housing costs, think about downsizing or sharing an apartment with someone.

Transportation Necessities

Transportation costs, like car payments, insurance, gas, and maintenance, are also big. Using public transport, carpooling, or biking can lower these costs.

Groceries and Basic Food

Groceries are a must. To save on food, plan meals, use coupons, and buy in bulk. Also, try meal prepping to cut down on food waste.

Healthcare and Insurance

Healthcare costs, like insurance, out-of-pocket expenses, and prescriptions, are essential. Staying healthy can help lower some of these costs.

| Category | Average Monthly Cost | Tips for Reduction |

|---|---|---|

| Housing | $1,500 | Downsize, find a roommate |

| Transportation | $800 | Public transport, carpool, bike |

| Groceries | $500 | Meal planning, coupons, bulk buying |

| Healthcare | $300 | Healthy lifestyle, preventive care |

By knowing and managing these essential costs, you can use your 50% for needs wisely. This helps build a solid financial base.

Allocating 30% to Wants

Learning to spend 30% of your income on wants is key for a good budget. This part of your budget is for things that make you happy and improve your life.

Entertainment and Dining Out

Entertainment and dining out are big parts of the 30% for wants. Enjoying new restaurants, movies, or concerts adds to your happiness. Plan your outings and look for deals to save money.

Shopping and Non-Essential Purchases

Buying non-essential items can be a fun treat. This includes clothes, accessories, or gadgets that make you happy. To stay on budget, focus on what you really want and avoid buying on impulse. Making a shopping list helps you stay on track.

Subscription Services and Memberships

Subscription services and memberships also fall under the 30% for wants. This includes streaming services, gym memberships, or magazine subscriptions. Check these regularly to see if they’re worth it. Cancel any that don’t bring you joy or value.

Hobbies and Recreation

Investing in hobbies and activities is important for growth and relaxation. Whether it’s painting, playing music, or traveling, these activities make life richer. Use some of your 30% for wants to support your hobbies and try new things.

By wisely using your 30% for wants, you can live a fulfilling life while keeping your budget in check. It’s about finding a balance that meets your financial and personal goals.

Maximizing Your 20% for Financial Goals

The 20% of your income is a powerful tool for building a strong financial base. By managing this amount well, you can achieve big financial gains over time.

Building Your Emergency Fund First

An emergency fund is key to any personal finance plan. It acts as a safety net for unexpected events like medical emergencies or job loss. Try to save 3-6 months’ worth of living expenses in an easily accessible savings account.

“The rule of thumb is to save enough to cover your living expenses for a few months. This provides a cushion in case of unexpected events.”

Strategic Debt Repayment

High-interest debt can slow down your financial progress. Use part of your 20% for strategic debt repayment to clear this debt. Start by paying off loans and credit cards with high interest rates first.

- List all your debts, including credit cards and loans.

- Prioritize debts with the highest interest rates.

- Consider debt consolidation if it simplifies your payments and reduces interest.

Retirement Savings Strategies

Planning for retirement is vital. Use tax-advantaged accounts like 401(k) or IRA to grow your savings. Make sure to contribute enough to get any employer match, as it’s free money.

| Retirement Account Type | Benefits |

|---|---|

| 401(k) | Employer matching, tax-deferred growth |

| IRA | Tax-deductible contributions, tax-deferred growth |

Other Investment Opportunities

Look into other investments to grow your wealth. This could be stocks, bonds, or real estate. Diversifying helps manage risk and increase returns.

- Assess your risk tolerance and financial goals.

- Diversify your investments across different asset classes.

- Regularly review and adjust your investment portfolio as needed.

Maximizing your 20% for financial goals can secure your future. Whether it’s for an emergency fund, debt repayment, retirement savings, or other investments, a solid personal finance plan is key.

How to Implement the 50/30/20 Budget Rule in 5 Steps

Starting the 50/30/20 budget rule might seem hard, but it’s easier when broken down. This method helps you manage money by dividing it into needs, wants, and savings. It’s a simple way to keep your finances in order.

Step 1: Calculate Your After-Tax Income

First, figure out your after-tax income. This is what you have left after taxes. To find it, subtract taxes from your gross income. Using this amount for budgeting ensures you’re working with what you really have.

Step 2: Track Your Current Spending Patterns

It’s important to know where your money goes. For a month, track every purchase and categorize it. This will show you where you can cut back to fit the 50/30/20 rule.

Step 3: Categorize Your Expenses Properly

Correctly sorting your expenses is vital. Needs are things like rent, utilities, and food. Wants are things like dining out and hobbies. Savings are for emergencies and retirement. Accurate categorization leads to a balanced budget.

Step 4: Adjust Your Spending to Match the Rule

After understanding your income and expenses, adjust your spending. You might cut back on wants, optimize needs, or increase income for savings. Regular budget reviews keep you on track.

By following these steps and sticking to your budget, you can achieve financial stability. This will help you reach your long-term financial goals.

Common Challenges with the 50/30/20 Budget Rule

The 50/30/20 budget rule is a simple way to manage money. But, many people face challenges that make it hard to follow. Knowing these challenges helps you make changes and reach financial stability.

When Your Needs Exceed 50%

Sometimes, you might spend more than 50% of your income on needs. This can happen in places with high living costs. To deal with this, look for ways to lower your housing costs. Downsizing or getting a roommate are good options.

| Expense | Average Cost | Cost-Saving Measures |

|---|---|---|

| Housing | $1,500/month | Downsize or find a roommate |

| Transportation | $500/month | Use public transport or carpool |

| Groceries | $300/month | Meal planning and bulk buying |

Distinguishing Between Wants and Needs

One big challenge is telling wants from needs. Keeping a record of your spending helps. It makes you think more about your money choices.

Finding Extra Money for the 20% Savings

Setting aside 20% for savings can be tough, mainly when money is tight. Use a budgeting app to track your spending. It shows where you can save more.

- Review your budget regularly to identify unnecessary expenses.

- Consider automating your savings through direct deposits.

- Explore additional income sources, such as a side job or freelance work.

Adjusting for Irregular or Freelance Income

For those with unpredictable income, the 50/30/20 rule is harder to follow. Average your income over a few months to find a steady budget. This helps even out financial highs and lows.

By tackling these common issues, you can better use the 50/30/20 budget rule. This way, you can reach your financial goals.

Adapting the 50/30/20 Rule for Different Life Stages

As people grow older, their money needs change. The 50/30/20 budget rule is flexible. It helps fit different life stages and goals.

For Young Adults and New Graduates

Young adults and new grads focus on building a solid financial base. They often pay off debts and save for emergencies. They might spend more on basic needs like housing and food.

Start with the 50/30/20 rule, then tweak it based on your situation. For example, if you live with parents, you could save more or pay off debt faster.

For Families with Children

Families with kids have extra costs like school and childcare. They might need to spend less on wants to cover these needs.

| Expense Category | Typical Allocation | Adjusted Allocation for Families |

|---|---|---|

| Needs | 50% | 55% (including childcare) |

| Wants | 30% | 25% |

| Savings | 20% | 20% (with a focus on education savings) |

For Mid-Career Professionals

Mid-career folks often earn more, which helps with saving and investing. They might save more in their 20% savings slot.

It’s key for them to check their budget often. This ensures it matches their changing financial goals, like saving for college or retirement.

For Pre-Retirement Planning

As retirement nears, saving for it and cutting costs become top priorities. Budgets may need to adjust for less income and more healthcare costs.

Pre-retirees should look to cut back on non-essential spending. This frees up money for retirement savings.

By tailoring the 50/30/20 rule to each life stage, people can craft a personal finance plan that suits their needs. This boosts their chances of financial stability and success.

Digital Tools and Apps to Support Your 50/30/20 Budget

Modern digital tools and apps make the 50/30/20 budget rule easier to follow. They help track income and expenses. This makes sticking to the budget simpler.

Budgeting Apps That Support This Method

Many budgeting apps help with the 50/30/20 rule. Some top choices include:

- Mint: Known for its detailed financial tracking.

- You Need a Budget (YNAB): Helps manage money by assigning jobs to every dollar.

- Personal Capital: Gives a full view of your finances, including investments.

These apps make it easy to categorize expenses. This helps follow the 50/30/20 rule.

Spreadsheet Templates for Detailed Tracking

Spreadsheet templates are great for those who like to manage their finances hands-on. Google Sheets and Microsoft Excel have templates for the 50/30/20 rule. They let you track expenses and income in detail.

Using spreadsheet templates has many benefits:

- Customization: You can adjust the spreadsheet to fit your financial needs.

- Flexibility: Spreadsheets can be updated to show changes in income or expenses.

- Visibility: A good spreadsheet gives a clear view of your finances.

Automation Tools for Saving and Investing

Automation is key for saving and investing with the 50/30/20 rule. Tools like:

- Qapital: Saves money automatically based on spending habits.

- Digit: Transfers small amounts from checking to savings.

- Acorns: Invests spare change from daily purchases into a diversified portfolio.

Automation helps save and invest consistently. It makes reaching financial goals easier without extra effort.

Real-Life Success Stories Using the 50/30/20 Method

Real-life success stories show the 50/30/20 method’s impact on personal finance. This money management rule has helped many achieve financial stability. It’s simple yet effective.

How Sarah Paid Off $30,000 in Debt in Two Years

Sarah, a marketing professional, had $30,000 in debt. She used the 50/30/20 rule to focus on debt repayment. She saved 20% of her income, paying off her debt in two years.

John’s Journey to Financial Independence

John, a freelance writer, faced income irregularities. But the 50/30/20 rule helped him manage his finances. He saved 20% of his income, adjusting his spending to fit the rule.

The Martinez Family’s Budget Transformation

The Martinez family, with two young children, changed their finances with the 50/30/20 rule. They categorized expenses into needs, wants, and savings. This led to better spending habits and a stable financial future.

These stories prove the 50/30/20 method’s power as a money management rule. It’s a simple yet effective income allocation strategy. It helps individuals and families achieve big financial wins.

Conclusion: Making the 50/30/20 Budget Rule Work for You

The 50/30/20 budget rule is a simple yet powerful way to manage your money. It divides your income into three parts: 50% for needs, 30% for wants, and 20% for savings and debt. This helps you plan your spending and saving better.

Using this rule can really change how you handle money. It helps you focus on what’s important and make smart money choices. It’s great for paying off debt, building an emergency fund, or saving for retirement.

By following this guide and using digital tools, you can make the 50/30/20 rule a part of your life. Start now and feel the relief of having a clear budget plan.