Managing my finances well is key to financial stability and security. Understanding and categorizing my expenses is a big step.

Having a detailed list of budget categories lets me see where my money goes. This helps me make smart spending choices.

By sorting my expenses into categories, I find ways to save. I can use my money more wisely.

Key Takeaways

- Understanding budget categories is essential for effective financial management.

- A detailed list of budget categories helps track expenses.

- Categorizing expenses enables informed decisions about spending habits.

- Identifying areas to cut back on leads to more efficient resource allocation.

- A well-organized budget helps achieve financial stability and security.

Why Budget Categories Are Essential for Financial Success

Organizing your expenses into categories is key to financial success. It helps you understand where your money goes. This makes managing your finances easier.

The Psychology Behind Categorizing Your Money

Categorizing your money helps create a clear separation between different expenses. For example, having a category for entertainment can help you stay within your budget for dining out or movies.

How Proper Categories Prevent Overspending

Proper budget categories prevent overspending by setting specific amounts for different expenses. This avoids the mistake of using money meant for essential expenses.

Setting Yourself Up for Long-Term Financial Health

By categorizing your expenses, you can prioritize your spending. This ensures you’re saving for long-term goals, like a house or retirement.

| Category | Monthly Allocation | Percentage of Income |

|---|---|---|

| Housing | $1,500 | 30% |

| Entertainment | $500 | 10% |

| Savings | $1,000 | 20% |

Effective categorization and allocation of your income can greatly improve your financial health. By understanding and using budget categories, you can make better money decisions.

Getting Started with Your Budget Framework

Creating a budget framework is the first step to financial stability. It helps you manage your money by tracking income and expenses. This way, you can make smart money decisions.

Choosing the Right Budgeting Method for Your Lifestyle

Finding a budgeting method that suits you is key. You can pick from the 50/30/20 rule, zero-based budgeting, or envelope budgeting. The best choice depends on your financial goals and how you spend money.

Essential Tools for Category Tracking

To track your budget categories well, you need the right tools. Budgeting apps like Mint or Personal Capital, spreadsheets, or the envelope system are good options. Choose what works best for you and your financial style.

Setting Up Your Initial Category Structure

When setting up your budget, start with broad categories. Then, refine them as you get more comfortable. This helps you track your money accurately.

How Often to Review and Adjust Your Categories

It’s important to regularly review and adjust your budget categories. Do this at least every quarter, or when your income or expenses change a lot.

Master List of Personal Budget Categories

To get a clear picture of your finances, it’s key to know the different budget categories. A detailed budget helps you see where your money goes. It lets you decide how to use it wisely.

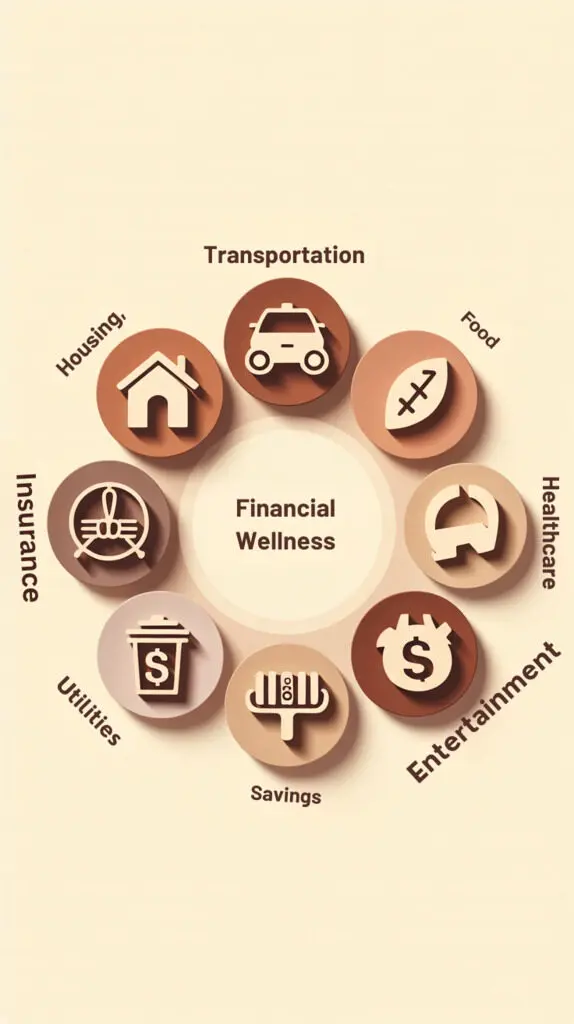

Overview of the Seven Major Category Groups

There are seven main groups in personal budget categories. These are income, housing, transportation, food, insurance, entertainment, and savings. Knowing these groups helps you make a budget that covers all your financial needs.

Housing costs include rent or mortgage, property taxes, and upkeep. Transportation expenses are car payments, gas, insurance, and public transit. Breaking down your spending into these areas helps you manage your money better.

Fixed vs. Variable Categories: Understanding the Difference

It’s important to know the difference between fixed and variable expenses. Fixed costs, like rent or mortgage, insurance, and subscriptions, stay the same each month. Variable expenses, like dining out, entertainment, and groceries, can change a lot.

As “The key to financial freedom is to focus on the things that matter most to you.” Knowing the difference helps you decide where to save and how to spend better.

How to Prioritize Categories Based on Your Financial Goals

Setting priorities in your budget is linked to your financial goals. Whether it’s saving for a house, paying off debt, or building an emergency fund, your budget should match these goals.

If you’re saving for a vacation, you might need to cut back on entertainment or dining out. As financial expert Dave Ramsey said,

“A budget is telling your money where to go instead of wondering where it went.”

By focusing on your financial goals, you make sure your money works for what’s important to you.

Income Categories: Tracking Every Dollar You Earn

To budget well, you must know where your money comes from. Categorizing your income is key for clear finances. It helps you decide how to use your money wisely.

Primary Income Sources

Your main income sources are the base of your financial health. These include:

- Salary or wages from your main job

- Tips or bonuses received from your employer

For most, their main income is their salary. But, if you get tips or bonuses often, include them in your budget too.

Secondary Income

You might also have secondary income. This includes:

- Side hustles or freelance work

- Part-time jobs or seasonal work

Secondary income can boost your main income and offer a safety net. It’s important to track it separately to see its full effect on your finances.

Passive Income Streams

Passive income is money that comes in with little effort. Examples are:

- Investments, such as dividends or interest

- Rental properties or real estate investment trusts (REITs)

- Royalties from intellectual property

Passive income can lead to financial freedom and help reach your long-term goals.

Irregular Income Planning

Not all income is steady. Irregular income includes:

- Bonuses or performance-based payments

- Tax refunds or other government payments

- Gifts or inheritances

Planning for irregular income means saving during good times for bad. This keeps your finances stable.

| Income Category | Examples | Tracking Tips |

|---|---|---|

| Primary Income | Salary, wages, tips | Record regularly in budget spreadsheet |

| Secondary Income | Side hustles, part-time jobs | Track separately to monitor impact |

| Passive Income | Investments, rentals, royalties | Monitor statements and record income |

| Irregular Income | Bonuses, tax refunds, gifts | Set aside funds during high-income periods |

By understanding and categorizing your income, you can better manage your finances and achieve your financial goals.

“A budget is telling your money where to go instead of wondering where it went.”

Essential Expense Categories for Basic Needs

To stay financially healthy, it’s key to know and track your basic expenses. These are the core of your monthly spending and are vital for budgeting well.

Housing

Housing costs are a big deal for most people. This includes mortgage or rent, property taxes, HOA fees, and upkeep. Homeowners also need to budget for repairs and maintenance.

Utilities

Utilities are another must-have expense. They cover electricity, water, gas, internet, and phone. These costs can change each month but are needed for everyday life.

| Utility | Average Monthly Cost |

|---|---|

| Electricity | $100-$150 |

| Water | $30-$50 |

| Internet | $50-$100 |

Food

Food costs include groceries and household items. Planning meals and making a shopping list can help control this area. Remember, dining out and takeout are not must-haves.

Transportation

Transportation expenses include car payments, gas, public transit, and vehicle upkeep. For car owners, regular maintenance is key to avoid expensive fixes later.

Understanding and organizing these essential expenses helps you manage your finances better. It allows you to make smart choices with your money.

Lifestyle and Discretionary Spending Categories

Understanding our lifestyle and spending habits is key to good finances. These areas include things we don’t need but make life better. By managing these, we can use our money wisely.

Entertainment

Entertainment costs include things like streaming, movies, concerts, and hobbies. Having a budget for fun helps avoid spending too much. For example, setting a monthly budget for streaming services can keep costs down. Services like Netflix, Hulu, and Disney+ are popular choices.

Personal Care

Personal care costs include haircuts, gym memberships, clothes, and beauty items. Choosing what we really need over what we want can save a lot. For instance, cheaper gym memberships or bulk beauty buys can cut costs.

Dining Out and Social Activities

Dining out and social events are big parts of discretionary spending. Having a budget for these can keep finances in check. Cooking at home, choosing cheaper dining, and limiting social events are good strategies.

Subscriptions and Memberships

Subscriptions and memberships, like software, gyms, and monthly boxes, add up fast. It’s important to check if we’re using them. Canceling unused ones or getting better deals can save money.

Managing lifestyle and discretionary spending well means keeping an eye on it and making changes as needed. Knowing where our money goes helps us spend more thoughtfully. This leads to better financial health.

- Track your discretionary spending to identify areas for improvement.

- Set realistic budgets for entertainment, personal care, and dining out.

- Regularly review subscriptions and memberships to ensure they are needed.

Financial Obligation Categories

To find financial peace, it’s key to know and sort your financial duties. Handling these duties well is vital for a healthy budget and lasting financial health.

Debt Repayment

Debt repayment is a big financial duty that includes credit cards, student loans, and personal loans. Focusing on paying off debt can lessen financial stress. It also frees up more money for savings and investments.

Insurance Premiums

Insurance premiums, like life, auto, home, and disability insurance, are key financial duties. They protect you from unexpected events. Having the right coverage is important for financial safety.

Tax Obligations

Taxes, such as income, property, and self-employment tax, are major financial duties. Knowing your tax duties helps you plan and avoid fines.

Child-Related Expenses

Expenses for kids, like childcare, education, and activities, are big financial duties for many families. Sorting these costs helps you budget better and make smart financial choices.

| Financial Obligation Category | Examples | Importance Level |

|---|---|---|

| Debt Repayment | Credit cards, student loans, personal loans | High |

| Insurance Premiums | Life, auto, home, disability insurance | High |

| Tax Obligations | Income tax, property tax, self-employment tax | High |

| Child-Related Expenses | Childcare, education, activities | Medium |

By knowing and sorting your financial duties, you can manage your money better. This helps you reach your financial goals. Using money tracking categories and a detailed budget list is key in this journey.

Savings and Investment Categories

To secure your financial future, it’s key to have a solid savings and investment plan. You need to know and use different savings and investment types well.

Emergency Fund Allocations

An emergency fund is a must in any good financial plan. Aim to save 3-6 months’ worth of expenses. This fund helps with sudden costs like medical bills or car repairs.

Retirement Accounts

Planning for retirement is vital. Using accounts like 401(k), IRA, or Roth IRA can save you a lot on taxes. They also help your savings grow over time.

Short-Term Savings Goals

For short-term goals like a vacation or a new car, you need a different plan. Set aside money just for these goals. Choose the best savings tools, like high-yield savings accounts.

Long-Term Financial Goals

Long-term goals, like a home down payment or college fund, need steady effort and smart investments. Knowing about different investments, like stocks and bonds, helps you make better choices.

By organizing your savings and investments, you can manage your money better. This helps you reach your financial goals. Here are some important categories to think about:

- Emergency funds

- Retirement savings

- Short-term savings goals

- Long-term investment goals

Managing these categories well can make your financial future more secure.

Conclusion: Making Your Budget Categories Work for You

Managing your budget categories well is key to financial stability and success. By using the master list of personal budget categories, you can better control your spending. This helps you make smart financial choices.

It’s important to regularly check and tweak your budgeting categories. This keeps your financial plan up-to-date with your changing needs and goals. It helps you spot areas to improve, spend wisely, and use your resources better.

By organizing your income and expenses, you can focus on your financial duties. You can also make wise investments and aim for your long-term goals. Start managing your finances better today with a solid budgeting system that suits you.