Managing money as a mom can feel like a big task. But, the right tools can make it easy. I found that using a personalized income tracker really helps me keep track of my money goals.

Tracking my income helps me see where I can save money. This article will show you how a mom’s income tracker can help. Plus, we’ll share tips on making managing your money simple.

Key Takeaways

- Simplify financial management with a personalized income tracker.

- Identify areas to cut back and allocate funds efficiently.

- Stay on top of financial goals with easy income tracking.

- Discover tips for managing finances as a mom.

- Improve financial organization and reduce stress.

The Financial Reality of Modern Motherhood

Modern motherhood brings unique financial challenges. Moms manage family finances and deal with hidden costs like childcare. They also face career impacts.

The financial world for moms is tough due to societal expectations and a lack of advice. Traditional budgeting tools don’t meet moms’ needs. They must balance family and personal finances.

Unique Money Challenges Moms Face Today

Mothers today face many financial challenges. These include:

- The cost of childcare, which can consume a significant portion of the family budget.

- Career sacrifices, which can impact long-term earning and retirement savings.

- The need for flexible financial planning tools that can adapt to the changing needs of the family.

A moms financial tracking tool can help. It gives a clear view of the family’s finances and finds ways to save.

Why Traditional Financial Advice Often Fails Mothers

Traditional financial advice doesn’t fit all moms. A budgeting tool for moms should be detailed. It should handle the complexities of modern motherhood.

By understanding moms’ financial challenges and using the right tools, moms can manage their finances. They can make informed decisions for their family’s well-being.

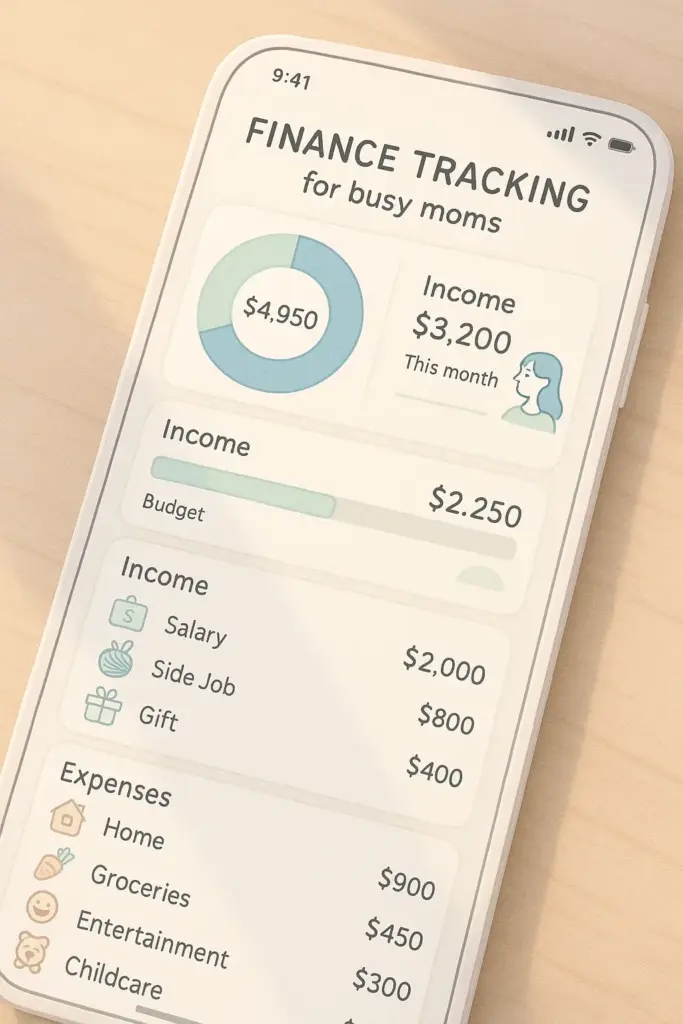

What Is a Moms Income Tracker and Why You Need One

Motherhood brings unique financial challenges. Knowing your income is key to financial confidence. As a mom, you handle your home and possibly multiple jobs or side hustles. A mom’s income tracker is essential here.

A mom’s income tracker is more than a budget app. It’s a tool for managing your finances well. With the best moms income tracker, you can understand your finances better. This helps you make smart choices and plan for the future.

Beyond Basic Budgeting: The Power of Income Awareness

Knowing your income is as important as tracking expenses. It lets you spot trends and prepare for changes. This awareness gives you control over your money.

Using moms finance management software helps you organize your income. You can track irregular earnings and non-cash benefits. This gives a full picture of your family’s financial health.

How Income Tracking Transforms Financial Confidence

Financial confidence comes from clear and controlled finances. An income tracker helps moms understand their money better. This confidence lets you make smart financial choices and plan ahead.

The best moms income tracker tools offer real-time data and alerts. They also show spending patterns. This info is key for making smart financial decisions.

The Psychological Benefits of Financial Clarity

Financial clarity has big mental benefits. Knowing where your money goes and how much you earn reduces stress. This clarity lets you focus on other life areas, feeling calm and in control.

Also, financial clarity boosts your self-esteem and confidence as a parent. You’re not just managing money; you’re teaching your kids about financial responsibility.

7 Best Mobile Apps for Busy Moms to Track Income

Busy moms need tools to manage their family’s money. Mobile apps are a great solution for tracking income. It’s important to find an app that is easy to use and powerful.

Mint: Best All-in-One Financial Tracker

Mint is a top app for tracking finances, including income. It connects to bank accounts and credit cards. This gives a clear view of your money. Mint is free, which is great for moms watching their budget.

YNAB: Best for Zero-Based Budgeting Moms

You Need a Budget (YNAB) is great for zero-based budgeting. It tracks income and expenses, making sure every dollar is used. YNAB offers a free trial, then it’s $6.99/month or $83.99/year. It’s perfect for income tracker for mom entrepreneurs with irregular income.

EveryDollar: Best for Simplicity and Ease of Use

EveryDollar is a simple budgeting app. It follows the zero-based budgeting principle. It’s free, but there’s a Plus version for $129/year with extra features.

Honeydue: Best for Co-Parenting Financial Management

Honeydue is for couples to manage their money together. It tracks income, bills, and expenses. It’s great for co-parenting moms to stay financially in sync with their partner.

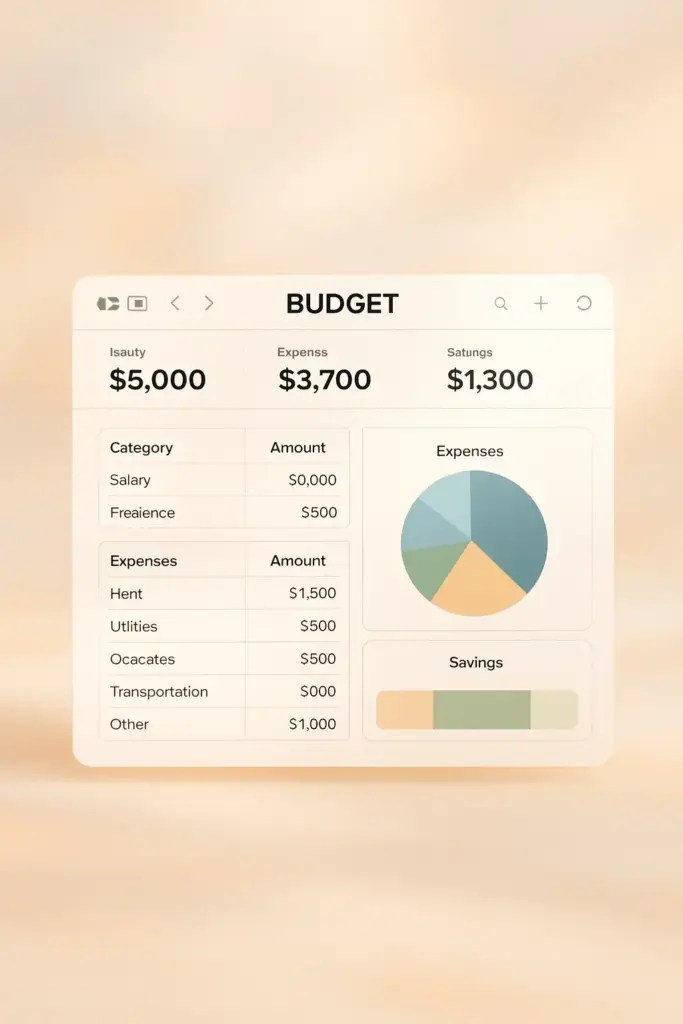

Digital Spreadsheet Solutions That Simplify Mom Life

The life of a modern mom is busy. But, with the right digital spreadsheet solutions, managing money is easy. You’re not just handling your family’s finances. You’re also juggling many tasks that need precision and organization.

Ready-to-Use Google Sheets Templates for Income Tracking

Google Sheets is a top choice for moms to track income. It’s easy to use and lets you work together. With ready-to-use templates, you can start tracking your income right away.

Google Sheets is great because it works on any device. You can check your income tracker anywhere. Plus, it lets you work together in real-time. This makes it easy to talk about money with your partner or kids.

| Template Features | Benefits for Moms |

|---|---|

| Automated Calculations | Saves time and reduces errors |

| Customizable Categories | Allows for personalized financial tracking |

| Real-time Collaboration | Facilitates family financial discussions |

Excel-Based Trackers with Time-Saving Automation

If you’re good with Excel, making an income tracker is a big help. Excel’s formulas and macros can do a lot of work for you. This makes tracking money more efficient.

“Using Excel for my income tracking has been a revelation. The automation features save me hours each month, and the flexibility to customize it to my needs is invaluable.” – Sarah, stay-at-home mom

Excel trackers can be made to fit your financial needs. Whether you have one income or many, it’s all about setting it up right. This way, you can easily see your financial situation.

Notion Templates for Visual Income Management

Notion is becoming popular among moms for its flexibility and looks. Notion templates for income tracking are customizable. They can be adjusted to fit your financial needs.

Notion stands out because it can mix different content types in one place. You can have tables, charts, and boards in your income tracker. This gives you a full view of your money situation.

- Customize your income tracker with Notion’s flexible templates

- Integrate various content types for a holistic financial view

- Access your tracker from any device, at any time

By using these digital spreadsheet solutions, moms can make managing money easier. They can reduce stress and understand their finances better. Whether you like Google Sheets, Excel, or Notion, there’s a solution for you.

Paper-Based Systems for Tech-Minimal Moms

In today’s digital world, some moms prefer old-school paper methods for tracking income. They find joy in managing their money with a hands-on approach.

Printable Income Tracking Worksheets That Actually Work

Using printable worksheets is a simple way to track income on paper. You can find them online or make your own. A good worksheet should have areas for income, expenses, and notes for irregular items.

- Identify your income sources and categorize them.

- Create a table or grid to track income over time.

- Include a section for recording expenses.

Bullet Journal Layouts for Financial Clarity

Bullet journaling is a hit for organizing life, including finances. By making a custom layout, moms can meet their financial needs. This might include spreads for budgeting, tracking expenses, and savings goals.

Here are some ideas for a bullet journal for tracking finances:

- A monthly spread with columns for income, fixed expenses, variable expenses, and savings.

- A dedicated page for tracking irregular income or expenses.

- A future log to plan and anticipate financial obligations.

Cash Envelope Systems for Tangible Money Management

The cash envelope system is a simple, visual way to manage expenses. It works by dividing expenses into categories and using labeled envelopes for budgeted cash. This helps moms stay on budget.

This system pairs well with a paper-based income tracker. Here’s how to set it up:

- Determine your budget categories.

- Label an envelope for each category.

- Place the budgeted amount into each envelope at the start of the budgeting period.

By combining these paper-based systems, moms can create a financial tool that suits them. It helps them manage money effectively.

Stay-at-Home Mom’s Guide to Financial Tracking

Tracking income is key for stay-at-home moms, just like for working moms. It helps us manage the household finances better. Knowing our income and expenses gives us power.

Managing Household Finances on a Single Income

Handling finances on one income needs careful planning. Here are some tips that help:

- Create a detailed budget for all expenses.

- Focus on needs over wants.

- Use cashback and rewards for shopping and bills.

Tracking the Monetary Value of Unpaid Work

My work as a stay-at-home mom is priceless, even if it’s unpaid. Seeing the value of my work can be surprising. Here’s how to do it:

- Figure out the cost of replacing my work (like childcare).

- Use online tools to value my parenting work.

- Understand how my work affects our finances.

Side Hustle Income Management for Extra Earnings

Many stay-at-home moms, like me, work side jobs to earn extra. Tracking this income is easy with the right tools:

- Keep side hustle income and costs separate.

- Sort income by source.

- Save for taxes on side job earnings.

These strategies help stay-at-home moms control their family’s money, even with one income. Using a stay-at-home mom income tracker has changed our financial health. It helps us make smart choices and plan for the future.

Mom Entrepreneur’s Financial Tracking Essentials

Mom entrepreneurs face unique financial challenges. They need special tools to track income, manage expenses, and plan for the future. As a mom entrepreneur myself, I’ve found that the right tools and strategies are key to success.

Separating Business and Personal Finances Effectively

One key step for mom entrepreneurs is to separate business and personal finances. This makes financial reporting clearer, tax prep easier, and business decisions more informed.

- Open a dedicated business bank account to keep business income and expenses separate from personal finances.

- Use accounting software that integrates with your bank account to streamline financial tracking.

- Regularly review and reconcile your business and personal accounts to ensure accuracy.

Tax Tracking Strategies to Maximize Deductions

Effective tax tracking is vital for mom entrepreneurs to maximize deductions and minimize tax liability. Here are some strategies to consider:

| Strategy | Description | Benefit |

|---|---|---|

| Categorize Expenses | Use accounting software to categorize business expenses accurately. | Easier identification of deductible expenses. |

| Track Mileage | Keep a log of business miles traveled for possible deduction. | Significant savings on taxes for business use of personal vehicles. |

| Home Office Deduction | Calculate the business use percentage of your home for office space. | Deduction for a portion of rent or mortgage interest and utilities. |

Irregular Income Planning for Business-Owning Moms

Mom entrepreneurs often face irregular income due to their business type. Planning for this irregularity is essential for financial stability.

Budgeting for variability is key. By creating a budget that accounts for income fluctuations, mom entrepreneurs can better manage their finances during lean periods.

Consider implementing a cash reserve system to cover essential expenses during months when income is lower. This proactive approach can reduce financial stress and provide peace of mind.

How I Revolutionized My Family Finances with a Moms Income Tracker

Using a simple income tracking tool changed our family’s finances. As a busy mom, managing our money was hard. We had expenses and income in different places.

My Financial Breaking Point: When I Knew Something Had to Change

I remember the day I knew we were spending too much. It was a busy morning, getting the kids ready. I was handling bills and income statements. The stress was too much, and I knew we had to change.

The System That Fianlly Worked for My Busy Mom Schedule

I found a mom’s income tracker that fit my life. It was a digital spreadsheet for income and expenses. It made tracking our money easy.

Surprising Insights I Gained About Our Family Income

The tracker showed us some surprises. Our biggest expense wasn’t rent or utilities. It was dining out and takeaways. Knowing this, we cut back and saved a lot.

With a mom budget tracker, I took control of our money. It reduced stress and helped us make smart money choices. It’s been key to our financial stability.

Setting Up Your Income Tracking System in 5 Easy Steps

Managing your family’s finances is now easier with a simple guide. As a mom, you handle many tasks at once. Tracking your income shouldn’t be hard. Here’s how to set up a good income tracking system in just 5 steps.

Step 1: Choosing the Right Tool for Your Lifestyle

First, pick a tool that suits your lifestyle. You can use mobile apps like Mint or YNAB, digital spreadsheets like Google Sheets or Excel, or even paper-based systems. Think about what works best for you and your family.

Step 2: Identifying and Categorizing All Income Sources

Next, list all your income sources. This includes your main job, freelance work, side hustles, or any regular income. Group these sources to see where your money comes from. You might have categories like ‘primary income,’ ‘freelance work,’ or ‘child support.’

Step 3: Establishing a Weekly Tracking Routine

Being consistent is important for tracking income. Choose a time each week to update your tracker. It could be every Sunday evening or Monday morning, based on your schedule. Make it a habit to record every income transaction accurately.

Step 4: Analyzing Income Patterns and Fluctuations

After tracking your income regularly, analyze the data. Look for patterns or changes in your income. Are there certain months when you earn more? Are there any irregularities you need to plan for? Understanding these patterns helps you make better financial decisions.

| Income Source | January | February | March |

|---|---|---|---|

| Primary Job | $4000 | $4000 | $4500 |

| Freelance Work | $1000 | $800 | $1200 |

| Child Support | $500 | $500 | $500 |

By following these 5 easy steps, you’ll create an effective income tracking system. It helps you manage your finances with confidence. The key is to be consistent and adjust as needed to keep your system working for you.

Common Income Tracking Mistakes Even Smart Moms Make

Managing your money as a mom is key, but even the smartest can slip up. Income tracking is more than just knowing how much you have. It’s about understanding your money flow to make smart choices. Despite many moms financial tracking tools and mom income tracking apps, many moms make avoidable mistakes.

Inconsistent Recording Habits and How to Fix Them

One big mistake is not keeping a consistent record of your money. This can lead to bad financial decisions. To avoid this, make a routine to update your records, whether daily or weekly. A mom income tracking app can make it easier to track your income anytime.

Overlooking Small or Irregular Income Sources

Moms often have many income sources, some small or irregular. Missing these can give a wrong view of your finances. It’s important to track all income, big or small, to use your money wisely.

Not Reconciling with Bank Statements Regularly

Not matching your tracked income with bank statements can cause problems. Regular checks help spot errors or fraud early. This keeps your financial records accurate.

Forgetting to Track Non-Cash Income Benefits

Many moms get non-cash benefits like tax credits or employer perks. These benefits have value and should be counted in your income. Including them gives a clear view of your financial health.

Knowing these common mistakes and how to avoid them helps moms manage their money better. The right moms financial tracking tool or mom income tracking app can greatly improve your financial record-keeping.

Conclusion: Empowering Your Mom Journey Through Financial Clarity

Getting financial clarity is a big step for moms. Using a moms income tracker lets you manage your money better. It makes it easy to track your income and make smart choices for your family.

With a good income tracking system, you can handle your household finances better. You’ll find ways to improve and spot chances to grow. This clarity helps you make confident choices, lowers stress, and balances your life.

Remember, financial clarity is an ongoing journey for moms. Keep checking and tweaking your tracking system to stay on top of your finances. With the right tools and attitude, you’re on your way to a brighter financial future for you and your family.